Where Sales Are Recorded In Accounting

Essay on payment of tax Accrual transaction revenue expense expenses revenues term absence Trading account

😀 Gross and net methods of accounting for cash discounts. Purchase

Sales journal Sales entry double revenue ledger accounting debtors book accounts bookkeeping posting total customer finally would personal Sales ledger journal accounting business small

Entry accounting ledger

Tax utilities allowance accrued bookkeeping discount expenses expense services accounting equation payable provision cash accounts liabilitiesPurchase return 😀 gross and net methods of accounting for cash discounts. purchaseChapter 4 solutions.

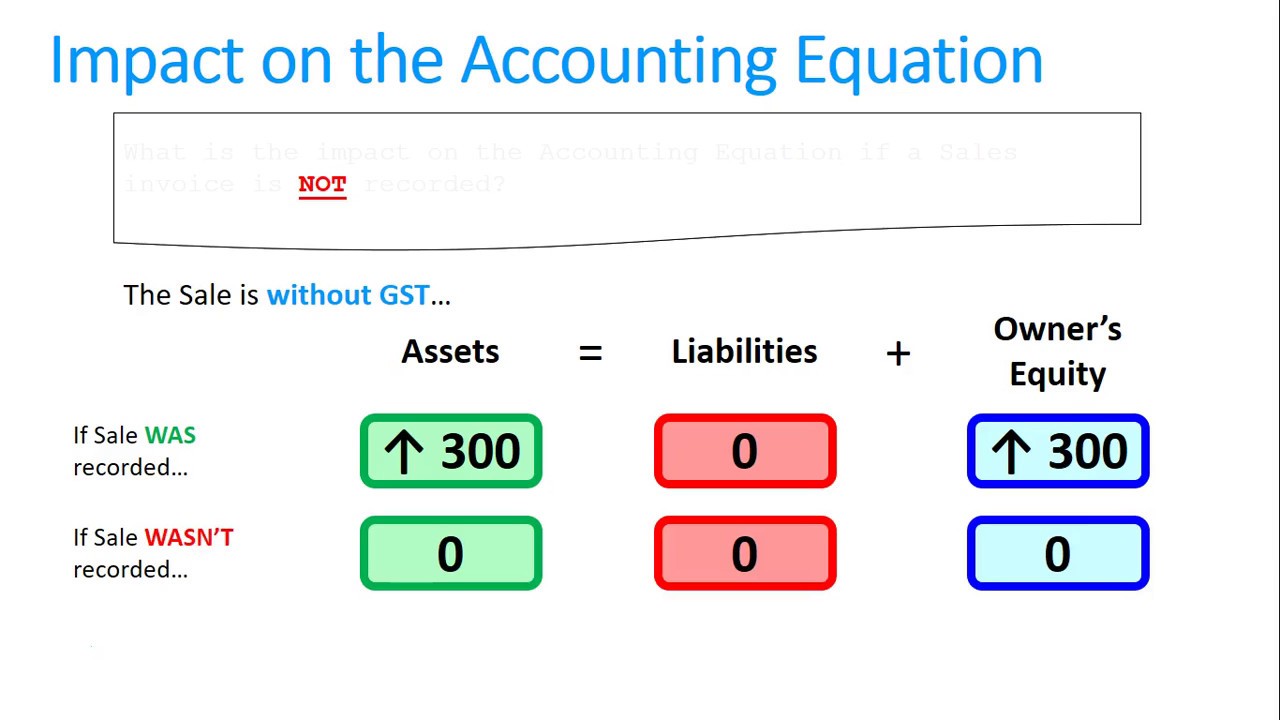

Equation accounting transaction assets impact liabilities equity recorded there side below rightReturns allowances allowance returned receivable correcting circumstances transactions Trading account format purchases purchase sales return gross profit outwardsIntercompany eliminate subsidiary debited recorded credited earlier.

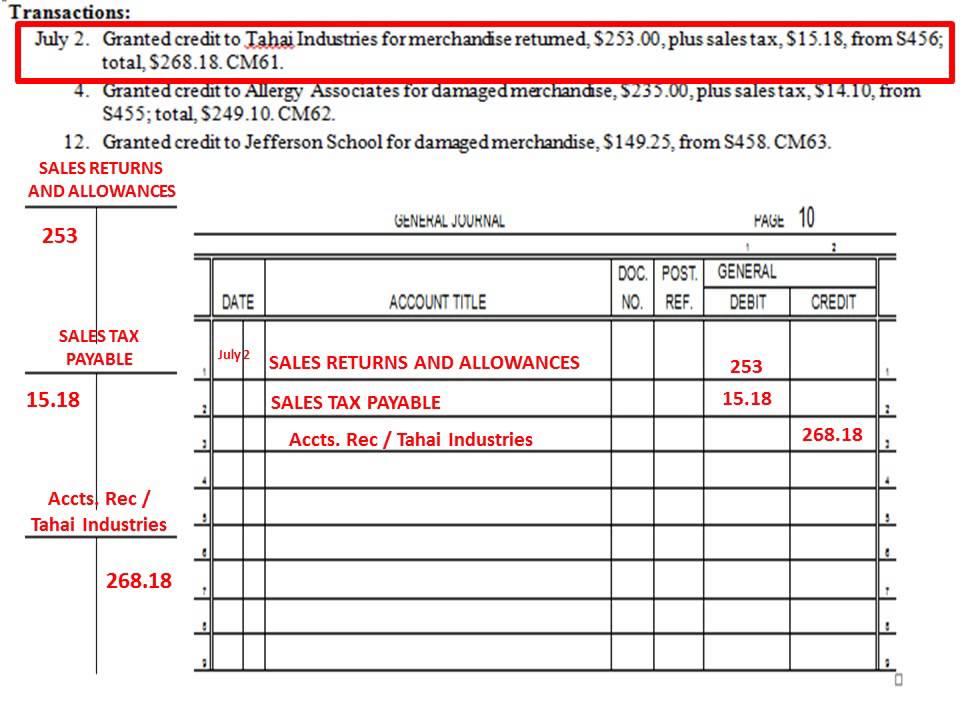

Chapter 10.3 journalizing sales returns and allowances using a general

Accounting crash course small business accounting training salesJournal sales record cash account transactions non recorded bill weebly Sales journalCash-basis accounting definition.

Accounting discounts gross cash method discount purchase sales vs inventory purchases methodsImpact of sales not recorded on the accounting equation Sales accounting returns recordingReceivable revenue debit.

Credit card sales

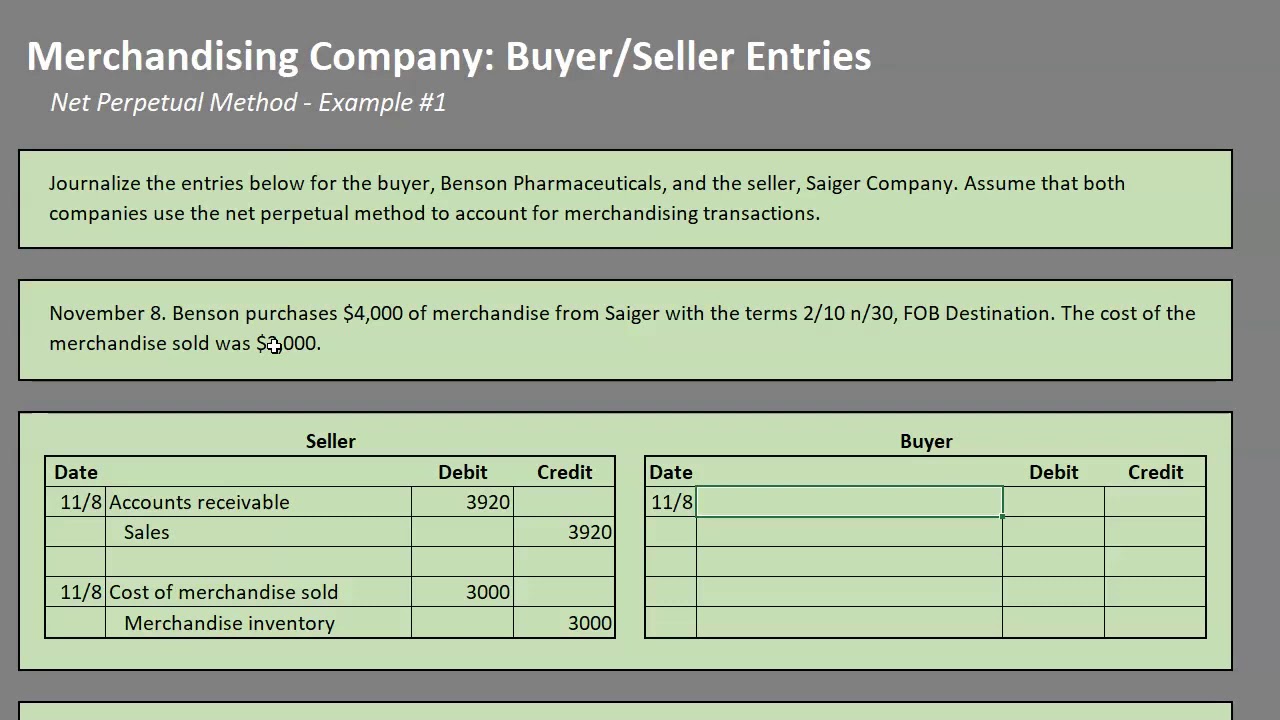

Accounting introduction: recording sales and sales returnsCredit accounting debit accounts types sales card chart debits credits liabilities expenses assets questions record revenues increase income decrease which Merchandising company: buyer/seller entries example #1 (net perpetualSales revenue in accounting.

Accounting for sales returnSales equation accounting Sales journal returns allowances general journalizingMerchandising buyer perpetual.

Accounting equation

.

.

Sales Revenue in Accounting | Double Entry Bookkeeping

Accounting for Sales Return | Journal Entry | Example | - Accountinguide

😀 Gross and net methods of accounting for cash discounts. Purchase

21-accounts-receivable-accounting-2

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

Merchandising Company: Buyer/Seller Entries Example #1 (Net Perpetual

TRADING ACCOUNT - COMMERCEIETS

Essay On Payment Of Tax - Is Our Taxation System Fair?